Top 3 reasons why money overwhelms, confuses, or even stresses out first responders…

For a lot of first responders, this may be the first time in their lives of having a steady paycheck. In fact, according to the TacMobility ACE Test Survey, 16% of the 775 first responders that participated said, that before the age of 18, they felt that they didn’t have enough food to eat, had to wear dirty clothes, had no one to protect them or their parents were too drunk or high to take care of them.

While this is jarring to hear, this means that many people are having to develop financial literacy on their own because perhaps they never saw it practiced in a healthy way. And, well, not everyone has the time to learn or has people to teach them. That’s why, for the month of June, we teamed up with Priority One Financial Coaching to create a savings challenge and develop awareness around money.

According to Rebecca Jameson, founder of Priority One Financial Coaching and wife to a deputy sheriff, her family found themselves stuck in the age-old “overtime and over spending cycle” that keeps so many first responder families feeling overwhelmed and in over their heads with debt. She and her husband were able to develop a manageable budget, pay off over a hundred thousand dollars in debt and create a savings for a 3 month maternity leave.

Admittedly so, Rebecca went “full send” on becoming debt-free and while not everyone has that same kind of dedication to hardcore savings, it inspired her to become a financial coach through the FCA (Financial Coach Academy) so that she could serve other first responder families with the gift of money management.

Important takeaway: very few people grew up with their parent’s teaching them how to manage their finances – which is why we wrote this blog.

It’s time to stop being ashamed or embarrassed about what you do and don’t know about money.

Top 3 reasons why money overwhelms, confuses, or even stresses out first responders…

Make money, spend money (lifestyle creep): this is the phenomenon where our expenses increase at the same rate as our income. Perpetually keeping us in this state of “not having enough money” even though we continue to make more. Ironically, this leads us to #2 on this list. If you’re a high earner and you can’t figure out why you have little to show for it…this may be an area that’s holding you back.

Once poor, always poor (scarcity mindset): This is when we continue to focus on what we LACK instead of being grateful for what we HAVE. Most of us in the first responder lifestyle make enough money to put food on the table, a roof over our heads, gas in our tanks & even some lifestyle upgrades. Scarcity mindset is when we focus on the things we DON’T have (or tell ourselves we CAN’T have) because of our “lack of funds”. It can also be exacerbated by what we see on TV, Social Media, (and even what we see driving up in the station parking lot), but, is also sometimes a part of a much bigger mindset challenge…which is #3.

You got it from your mama…or daddy: Most of how we view money as an adult, stems from how money was talked about (or not talked about) around us as a kid. If our parents constantly had negative conversations about money that our little kid brains overheard, we absorbed those messages which now dictate how we view, spend & feel about our money as adults

The only way to break these learned behaviors, is to become intentional and take actions to do things differently than you have before.

We invite you to join our TacMobility Wellness Community as we jump into our first-ever money savings challenge!

For the entire month of June, we are going to build our savings “muscle” by choosing a challenge:

Option 1: Percentages

· Good: Save 5% of take home pay, or $175

· Better: Save 10% of take home pay, or $350

· Best: Save 15% of take home pay, or $525

These percentages can be increased/decreased based on your specific situation. The point is to start somewhere and see what you can accomplish.

Option 2: Fixed Savings

· Print out the free June savings worksheet - choose a square with the dollar amount you want to save & shade it in. Do this daily for the entire month.

If you’ve never done a savings challenge or you’re living paycheck to paycheck, this beginners option is very manageable and interactive.

Success Blueprint:

Step 1: Establish your Good/Better/Best savings or Fixed savings goal for the month of June.

Step 2: Get clear on your WHY. Why do you want to complete this challenge? What are you saving for? What would it mean to you to reach your Good/Better/Best or Fixed Savings goals?

Step 3: For savings option 1, set up a plan to automatically transfer your “Good” goal into savings for each paycheck received in the month of June. For option 2, print out the Fixed Savings worksheet and label an envelope with your “why”. This is where you’ll place the money that you save each day.

Step 4: Follow @tacmobility and @bluelinemoneycoach on IG for tips and tricks shared this month.

·

Written by Erica Gaines

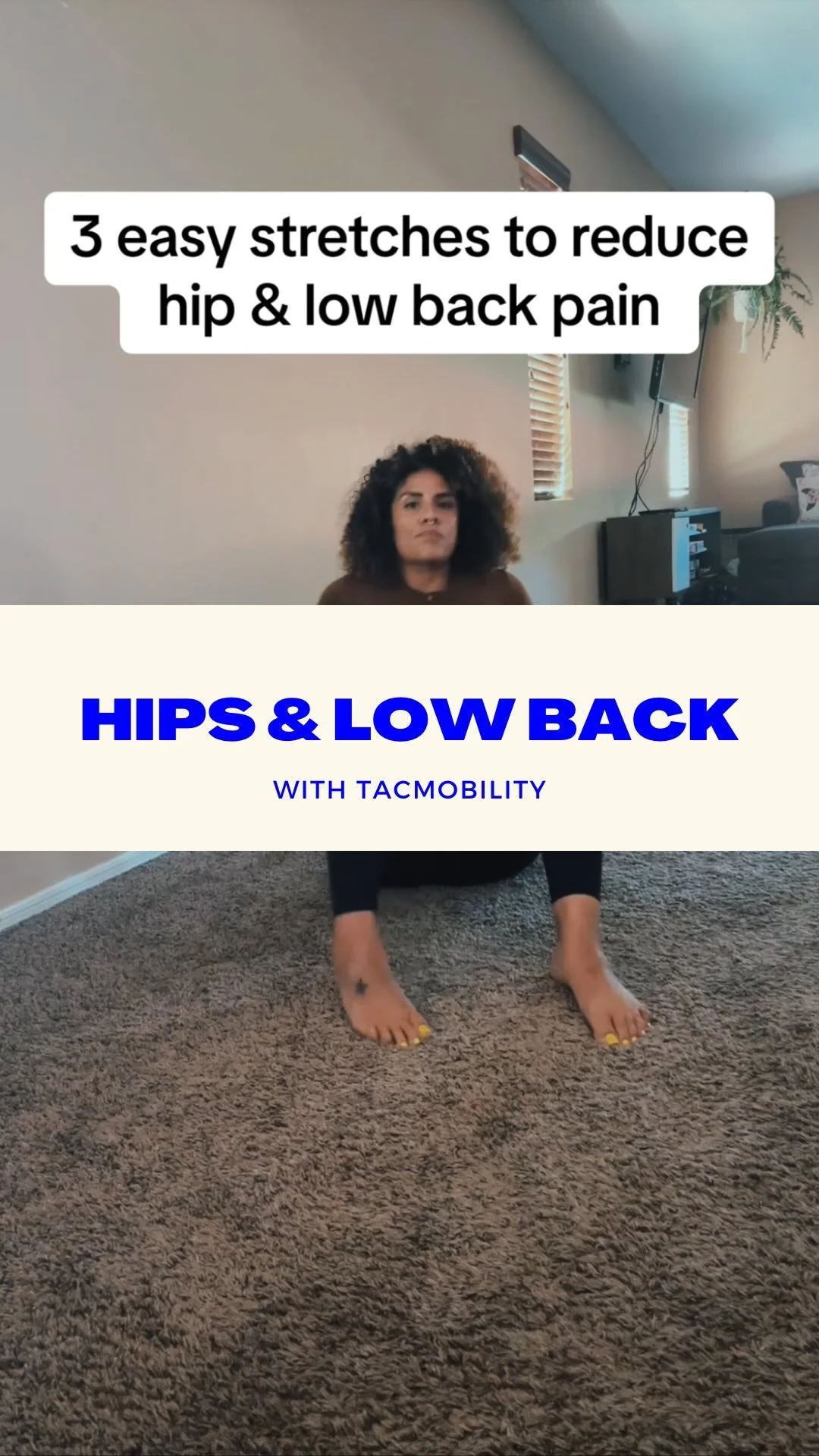

Erica is the CEO/Founder of TacMobility. She is a subject matter expert in law enforcement trauma and stress exposure and is the author of the world’s largest on-going data research survey of Law Enforcement officers and stress. Erica is certified in trauma yoga therapy.

#lawenforcement #police #stress #work #burnout #tacmobility #mentalhealth #wellness #recovery #anxiety #anxious #stressreduction #policelife #copsofinstagram #policeofficers #lawenforcementofficer #firstresponder #cops #coplife #policelife #policeofficer

Join us on Instagram!

Short Staffed and Burnt Out?

Our eCourse can be taken whenever, whereever

The Complete Officer Wellness & Resiliency Masterclass is hundreds of hours of stress education simplified by officer wellness expert, Erica Gaines. If you've ever found yourself operating at a lower level and maybe a little depressed or sluggish, this masterclass will inspire and guide you toward a healthier you 💪🏽 Experience engaging visual aids that help make sense of your body's stress and get guided practice using tension reliving techniques